|

Listen to our posts

|

The latest rumor flying around the Crypto Twittersphere is that 0x will be added to Coinbase in 2018.

For the past few months I have been trying to make some educated guesses at what Coinbase or GDAX might add for coins or tokens in 2018. If you are not aware of why that matters, the general consensus is that Coinbase adding any coin will boost that coins price and value. This is because Coinbase and GDAX currently have just 3 coins listed and sign up 100k customers a day. The demand for new offerings (and cheap alternatives to Bitcoin, Ethereum, Litecoin) is there, and a less expensive token will instantly be gobbled up, driving the price through the roof.

I have spent the past month or so looking into 0x as an asset to own in my portfolio. I was also interested in where it might be headed over the coming months. While researching I discovered and put together the following information, which I thought I would share in this post. Personally, I am bullish on 0x and the 0x token ZRX. I am bullish that the price will go up even if it is not listed on Coinbase as I believe in the overall project and its potential. However, a Coinbase listing will send it far beyond any potential normal increase in price.

Disclaimer: I have a long position in ZRX. None of what I write is investment advice, and please do you own research…

0x is best described by Advisor Linda Xie, who has written a good beginners introduction to 0x here

Briefly, “0x was co-founded by Will Warren and Amir Bandeali in October 2016. They envision a world in which every asset can be represented as a token on the Ethereum blockchain including fiat currencies, stocks, gold and digital game items. This tokenization will lead to thousands of tokens that need a method of trustless exchange. Decentralized exchanges have been a major step forward but there are still the remaining inefficiencies and lack of operability between decentralized exchanges. 0x aims to create a standard protocol on the Ethereum blockchain that allows any Ethereum token to be traded and for anyone to operate a decentralized exchange. These parties building on top of 0x are referred to as Relayers as they host off blockchain order books and can charge fees for their services.”

If you have no idea what any of that means, I suggest you start doing some general reading and stop buying any more crypto until you understand the basics.

Here are some reasons why I speculate 0x might be listed on Coinbase:

-

-

-

- Three advisors who all worked at Coinbase in prominent positions (Fred Eshram, Olaf Carlson-Wee, Linda Xie)

- Advisor Linda Xie just founded Scalar Capital, with former Coinbase employee Jordan Clifford. Maybe invested in 0x?

- The token ticks almost every required box in the recently released GDAX token framework

- An Interview with Linda Xie practically makes the case for adding it and how it matches GDAX requirements

- Coinbase added employee Charlie Lee’s Litecoin

- The GDAX token document lists Linda Xie and Jordan Clifford in the external thanks portion

- Others on Twitter have come to same conclusion as me

- Probably unrelated but sort of interesting, a new trading platform using 0x, looks identical to GDAX

-

-

I break out the above list of reasons in more detail below…

Three advisors previously worked at Coinbase:

-

-

- Fred Eshram is an advisor, he is a Coinbase Co-Founder, he left Jan 2017.

- Linda Xie is an advisor, she recently left Coinbase, she was the Product Manager. I believe she left Coinbase a short time after, or somewhere around the ZRX token launch.

- Olaf Carlson-Wee, An early employee at Coinbase. Heads up Polychain Capital, Polychain also invested in 0x.

-

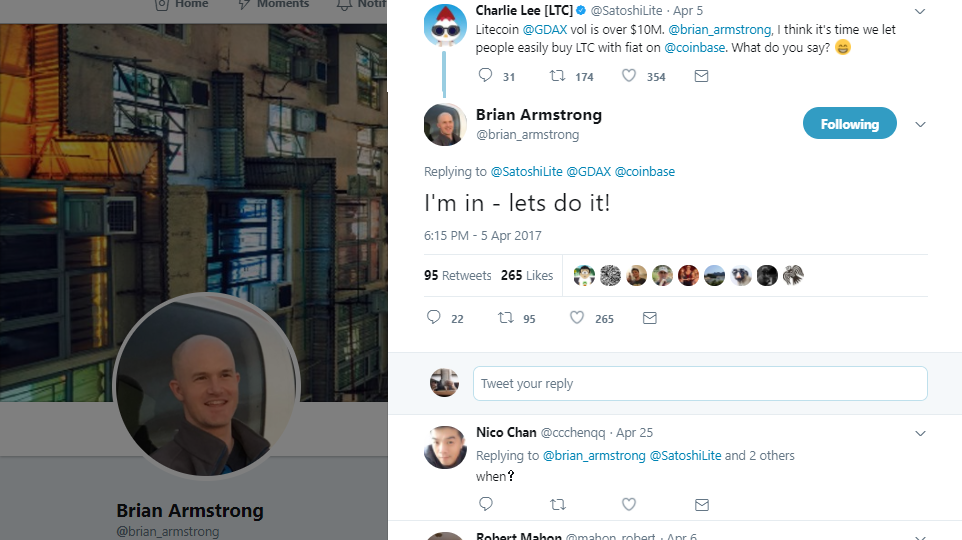

Charlie Lee and the Coinbase – Litecoin Connection

Charlie was at Coinbase for a few years. During that time he started Litecoin, a Bitcoin fork, that basically traded in low to ok volume and price. GDAX added Litecoin while Charlie still worked there in 2016.

In May of 2017 Coinbase adds Litecoin. The Coinbase price in 2017 went from around $20ish to $300 plus over this year. A month later in June, Lee leaves Coinbase. My guess is some lawyer advised them it was time to part ways because of conflicts. I would think at this point they would not add an asset to the exchange if it was founded/owned by a current employees.

The 3 advisors to 0x have all left over the past year and none are still Coinbase employees… So make of that what you will.

Also related, Litecoin was added to Coinbase at around 10M volume on GDAX. ZRX is averaging around 5m over the past month on just Poloniex and Binance exchanges. Assuming a GDAX add first will easily put it over the 10m daily, which would then make it an easy add on Coinbase given the volume created.

GDAX Token and Coin Framework

https://www.gdax.com/static/digital-asset-framework-2017-11.pdf

Besides the avisor connection I do think 0x fits well into what GDAX/Coinbase would accept as a new token. Note that there are 4 main points of the assessment of the digitial asset, AKA, token or coin. These are CODE, TEAM, GOVERNANCE, SCALABILITY. From the document they are defined as:

2.0 TECHNOLOGY Assessment of the asset and network.

2.1 Security & Code Assessment of engineering and product quality.

Source Code Open-source code, well-documented peer-review, and testing by contributors separate from the initial development team on GitHub, etc.

Prototype There is a working alpha or beta product on a testnet or mainnet.

Security Demonstrable record of responding to and improving the code after a disclosure of vulnerability, and a robust bug bounty program or third party security audit.

2.2 Team Assessment of short-term operating expectations and decision making.

Founders and Leadership, Able to articulate vision, strategy, use cases or drive developmental progress. Has a track record of demonstrable success or experience. If information is available, GDAX will apply “know your client” standards to publically visible founders or leaders.

Engineering Assessment of the engineering team and their track record of setting and achieving deadlines.

Business & Operations

History of interacting with the community, setting a reasonable budget and managing funds, and achieving project milestones. Thoughtful cash management is a key driver of the project’s long term viability.

Specialized Knowledge and Key People The project leadership is not highly centralized or dependent on a small number of key persons.

Specialized knowledge in this field is not limited to a small group of people.

2.3 Governance Assessment of long-term operating expectations and decision making.

Consensus Process There is a structured process to propose and implement major updates to the code, or there is a system or voting process for conflict resolution.

Future Development Funding (2) There is a plan or built-in mechanism for raising, rewarding, or allocating funds to future development, beyond the funds raised from the ICO or traditional investors.

White Paper

Justifies the use case for a decentralized network and outlines project goals from a business and technology perspective. While a white paper is important for understanding the project, it is not a requirement.

2.4 Scalability

Assessment of a network’s potential barriers to scaling and ability to grow and handle user

adoption.

Roadmap Clear timeline with stages of development, reasonable project milestones, or built-in development incentives.

Network Operating Costs The barriers to scaling the network have been identified, or solutions have been proposed or discussed.

The resource consumption costs for validators and miners are not the main deterrents to participation.

Practical Applications There are examples of real-world implementation or future practical applications.

Type of Blockchain The asset is a separate blockchain with a new architecture system and network, or it leverages an existing blockchain for synergies and network effects.

If you read about the 0x token ZRX, it seems to easily cover all of the above points and other points I did not list here.

But what really stands out to me is how Linda Xie emphasizes 2 of the 4 standards and some other GDAX token document keywords in this quote from a recent Coindesk article. I have bolded words that stand out to me in general and in relation to the GDAX document:

“If they’re going to be doing a decentralized governance system, the project founders or the coin creators themselves shouldn’t have a majority of these coins,” she said.

The flip side of risk is opportunity, and Xie is especially excited about coins where she considers the creators make shrewd decisions about governance.

Some recent examples of coins that did governance correctly from the start, in her view, are Tezos and 0x. These coins, she explained, are widely held, and allow their users to vote on protocol upgrades to mitigate scaling problems.”

Things that are mentioned both in her statement and in the GDAX document sections:

1) Governance (2.3 GOVERNANCE)

2) No Coin Majority (6.2 TOKEN SALE STRUCTURE)

3) From the Start (2.2 DECISION MAKING)

4) Widely Held (4.0 MARKET SUPPLY)

5) Users vote on protocol upgrades (2.3 GOVERNANCE)

6) Scaling (2.4 SCALABILITY)

I feel that the overall GDAX document matches up well with ZRX. Combined with the above statement from Linda, where she basically lays out the case, all bodes well for 0x to have a potential listing in 2018 on GDAX and Coinbase.

Note also that Jordan Clifford and Linda Xie the cofounders of Scalar Capital are both noted under the acknowledgements section of the GDAX document and obviously had some involvement in its creation. Again this circles back to 0x and probably influenced their structure and token offering. The token is not a security from what I can tell, another big plus.

Paradex

Somewhat unrelated to my evidence but interesting is this new trading platform, Paradex, which is in Beta. The UI looks almost like GDAX. Joey Krug of Augur and Pantera capital, is an advisor to both 0x and Paradex. Augur has presented before at Coinbase and is another potential addition to Coinbase…

Twitter Speculates

So while I already had some thoughts on 0x being a good coin to buy for 2018 and some speculation about a Coinbase add, 2 traders I follow on Twitter have also recently speculated on 0x as a good 2018 coin to watch. This just reinforces my hypothesis and makes me think perhaps I am on the right track…

@Ledgerstatus on his new podcast (<—check it out) thinks because of some hype and the advisory team it might get added

“Project 0x: We discussed decentralized exchange protocols (DEXs) and whether it may be added to Coinbase.”

Also from the podcast but making his own videos on Youtube and is @CarpeNoctum who mentions 0x as a top coin in this episode for 2018 with a good chance of a Coinbase listing.

Conclusion

I could be totally wrong but I think there is a strong case for 0x in 2018. I am in long right now on ZRX as an asset that will appreciate 3-4x in the coming year without Coinbase. If Coinbase adds it I have no idea how high it might go, possibly $10-$20 range at least.

In closing, do your own research, this is not advice just the opinion of some Average Joe…

Good insight.

dont you think 0x is competition for coinbase?

Been long on 0x since ICO stage and only see bigger things in store for the future!!

Thanks Joe! 😉

Great insight on the Paradex call !